Real Estate Agents Who Know St. Louis

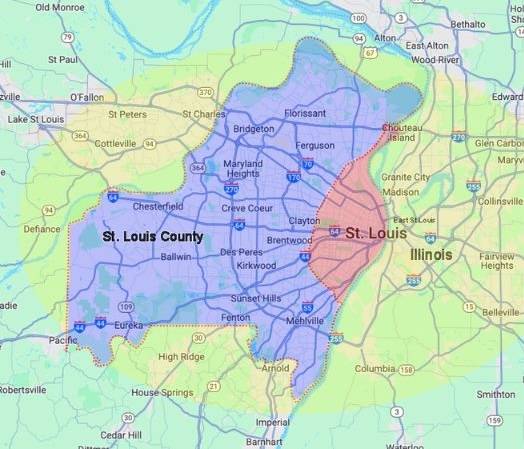

Gateway Realty Group is a full-service real estate team at Berkshire Hathaway HomeServices Select Properties. We specialize in St. Louis, St. Charles, and surrounding areas.

Our agents take pride in offering clients comprehensive, professional-grade services and honest, expert-level advice. Whether you are looking to buy your next home or list a current property, Gateway Realty Group is here to help.

WHAT WE DO

At Gateway Realty Group, we believe luxury is defined by an experience, not a price point. We leverage modern technology and the power of collaboration to create an experience second to none.

MEET THE TEAM

Award-Winning St. Louis Realtors

Gateway Realty Group is a full-service real estate team at Berkshire Hathaway HomeServices Select Properties specializing in St. Louis County, St. Charles County, and surrounding areas. Our agents take pride in offering clients comprehensive, professional-grade services and honest, expert-level advice. Whether you are looking to buy your next home or list a current property, Gateway Realty Group is here to help.

HELPING YOU FIND YOUR WAY HOME

Gateway Realty Group Combines Traditional Real Estate Values With Modern Methods To Help You Find Your Way Home.

WHAT OUR CLIENTS SAY

MOVING TO ST. LOUIS?

Learn Everything You Need To Know

Everything You Need to Know Before Moving to St. Louis, MO

Welcome to St. Louis, Missouri, the Gateway to the West. With its fantastic food scene, historic neighborhoods, and low cost

Pros and Cons of Living in St. Louis, MO in 2025

Explore the pros and cons of living in St. Louis, Missouri, from cost of living and job opportunities to weather and community life.

St. Louis County, MO Home Sale Statistics (June 2024)

We examined MLS data for 12,711 home sales in St. Louis County, MO, from June 2023 to June 2024. We

Top 10 Best High Schools in St. Louis in 2025

If you’re moving to St. Louis and schools are your top priority, this article breaks down the top 10 schools

Top 16 Best Suburbs in St. Louis, MO [Ultimate 2025 Guide]

Ahh, the suburbs of St. Louis are where the grass is greener, the schools are great, and the gossip is

20 Wealthiest Suburbs of St. Louis, MO (2025)

We examined MLS data to find the wealthiest suburbs of St. Louis, MO, ranked by median sale price. These

Frequently Asked Questions

Buyer Representation

Is It a Buyer’s or Seller’s Market in St. Louis?

Currently, the St. Louis market is a strong seller’s market. There are more people looking to buy a house than sell a house right now, giving sellers the upper hand. Homes are selling quickly, and often for top dollar.

How Long Does It Take To Buy a House in St. Louis?

It depends, and it’s always negotiable. If you’re using a conventional, FHA, or VA loan, the process is typically 30-45 days from writing an offer to closing. If you’re paying with cash, you can close in as little as 10-14 days. If you need extra time, we’ve had some clients opt for a 3-6+ month closing date, but the sellers have to agree to it.

How Much Money Do I Need Saved To Buy a House?

First, you’ll want to save for your down payment, which is typically 5% of the purchase price. Some loan programs allow less than 5%. You’ll also want to save for closing costs, which can range from 1-2+% of the purchase price on average. Lastly, there are other important but optional costs involved with purchasing a home you may want to plan for, including inspections, surveys, moving companies, etc.

It’s always a good idea to save for closing costs and have 6+ months’ worth of mortgage payments in reserves.

Do I Have to Put 20% Down?

No! A traditional conventional loan requires a minimum of 5% down. Some loan products even allow a 0-3% down payment. While it might sound nice to buy a house with $0 down, remember to budget for closing costs. It is important to note that if you put less than 20% down, you will have to pay PMI, private mortgage insurance.

Seller Representation

How Long Does It Take To Sell a House in St. Louis?

First, you need to get your home ready to list, then you’ll put it on the market. Fixing things before listing could take no time at all, or it could take 6+ months. Once your home is on the market, our sellers typically go under contract in 1-2 weeks, and then it’s usually 30-45 days until closing once an offer is accepted.

What Should You Fix Before Selling Your House?

If you have time and money to invest in getting your home ready, we recommend starting with anything major that needs repairs:

- HVAC

- Roof

- Foundation

- Electrical issues

- Deck

- Pests

If you don’t have anything major, then it’s a good idea to handle minor repairs like paint, windows & doors, faucets, appliances, and touch-ups around the house.

Should You Pay a Buyer’s Agent Commission?

It’s up to you, but there’s one reason our seller clients choose to offer a buyer’s agent commission: It gives you the largest pool of potential buyers. The more exposure your home gets, the more money you’ll make. If you choose not to offer compensation to a buyer’s agent, your home instantly becomes more expensive for the buyer. Not all buyers have additional funds to pay an agent on top of their down payment, since the commission can’t be rolled into most mortgages.